And as investors constantly look for investment opportunities, a high asset turnover ratio could attract new investors. Measure company performance – The asset turnover ratio is one method used to analyse a company’s performance.Read further to know about the advantages. The asset turnover ratio has wide importance for investors and may influence their investing decisions. Therefore, by benchmarking and comparing the asset turnover ratio to the industry average, you can establish whether it is functioning well. In this sense, comparisons are helpful when made between companies in the same industry. Despite lesser assets, this sector has a high turnover ratio! While conversely, the healthcare sector, with an impressive and large asset spread, does not enjoy a high turnover ratio. A low asset turnover ratio could be seen as a red flag.Īdditionally, the asset turnover ratio may be higher for some industries than others. For instance, a low ratio may indicate inadequate inventory management or excessive production capacity and more. Now, this value can be influenced by several factors.

The asset turnover ratio determines how effectively a company uses its assets to generate sales or revenue. This can conclude that XYZ Company could be more efficient with its use of assets. This means that for every rupee in assets, the company only generates an income of 16 paise. So the total asset turnover ratio of XYZ Company is: The following are the details found in the company’s financial statements. The investor wants to know how well the company uses its assets to produce sales. Let’s quickly understand the asset turnover ratio with an example.Īssume XYZ Company is a car manufacturing company currently looking for new investors and has a meeting with an angel investor. Remember, different industries can have different asset turnover ratio values. The asset turnover ratio formula is as below –Īsset turnover ratio = Net sales/Average total assets This ratio is fairly simple to calculate. It is paramount to compare this ratio only to companies in the same sector or industry.įormula, example and calculation of the asset turnover ratio.The higher the ratio, the better the company is at employing its assets.Investors and stakeholders use the ratio to judge a company’s performance and gauge how much revenue is being generated through its assets.

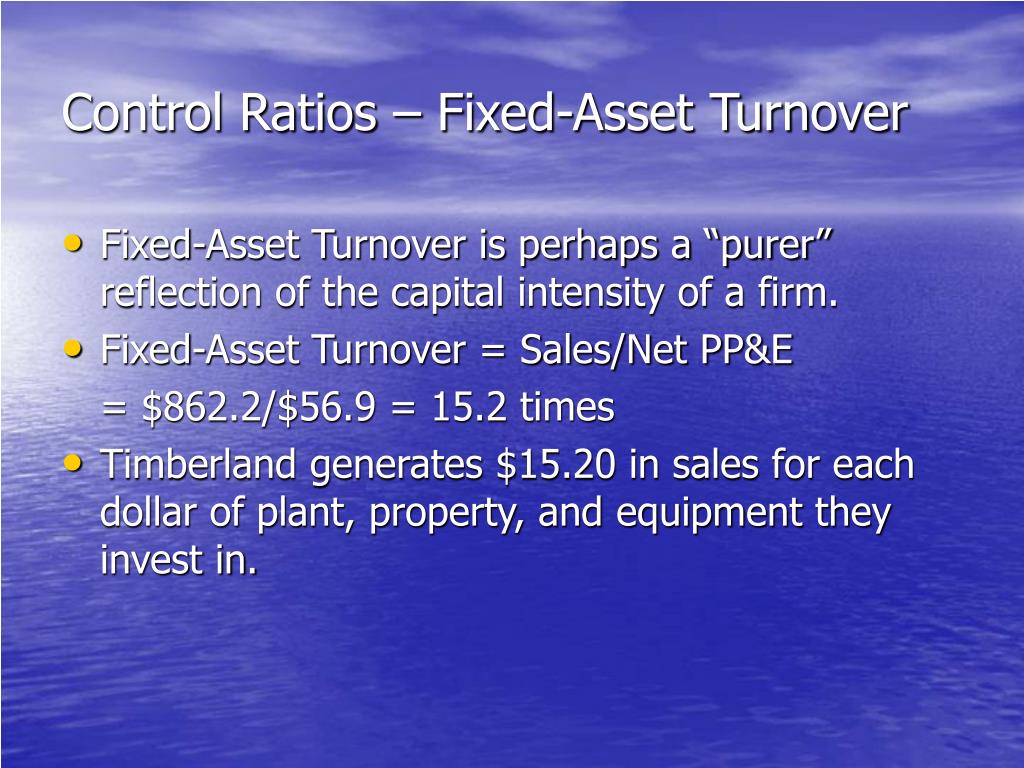

To illustrate, the following data (in millions) were taken from recent financial statements of Starbucks Corporation. The fixed asset turnover ratio measures the number of dollars of sales earned per dollar of fixed assets. A measure of a company’s efficiency in using its fixed assets to generate revenue is the fixed asset turnover ratio.

0 kommentar(er)

0 kommentar(er)